It’s time for retailers to start paying close attention to social media

Social media may still only drive a small share of total online retail sales, but its impact is becoming impossible to ignore. Social-driven retail sales and referral traffic are rising at a faster pace than all other online channels.

The top 500 retailers earned $3.3 billion from social shopping in 2014, up 26% from 2013, according to the Internet Retailer's Social Media 500. That is well ahead of the roughly 16% growth rate for the overall e-commerce market in the US.

Now new initiatives from a number of different social networks are making these platforms absolutely essential for retailers that want to drive sales and boost engagement.

In a new report from BI Intelligence we analyze social media's role in online retail — whether that's driving direct sales with the use of embedded "Buy" buttons on social media posts, or referring traffic to retailers' websites and apps. We measure the impact social media has on e-commerce by looking at metrics such as conversion rates, average order value, and revenue generated by shares, likes, and tweets. We also outline the latest commerce efforts by leading social networks.

Don't be left in the dark: Stay ahead of the curve and access our full report to get everything you need to know about social commerce trends. All in an easy to understand format with helpful graphs. Get the report now >>

Here are some of the key points from the report:

- Social is driving much bigger increases in retail traffic than any other online channel.Social media increased its share of e-commerce referrals nearly 200% between the first quarters of 2014 and 2015.

- For retailers to maintain these social gains, they will need to pay special attention to mobile, where social engagement with retail content is still limited. Social media users are 35% less likely to share a brand's or retailer's social post on mobile than they are on desktop computers.

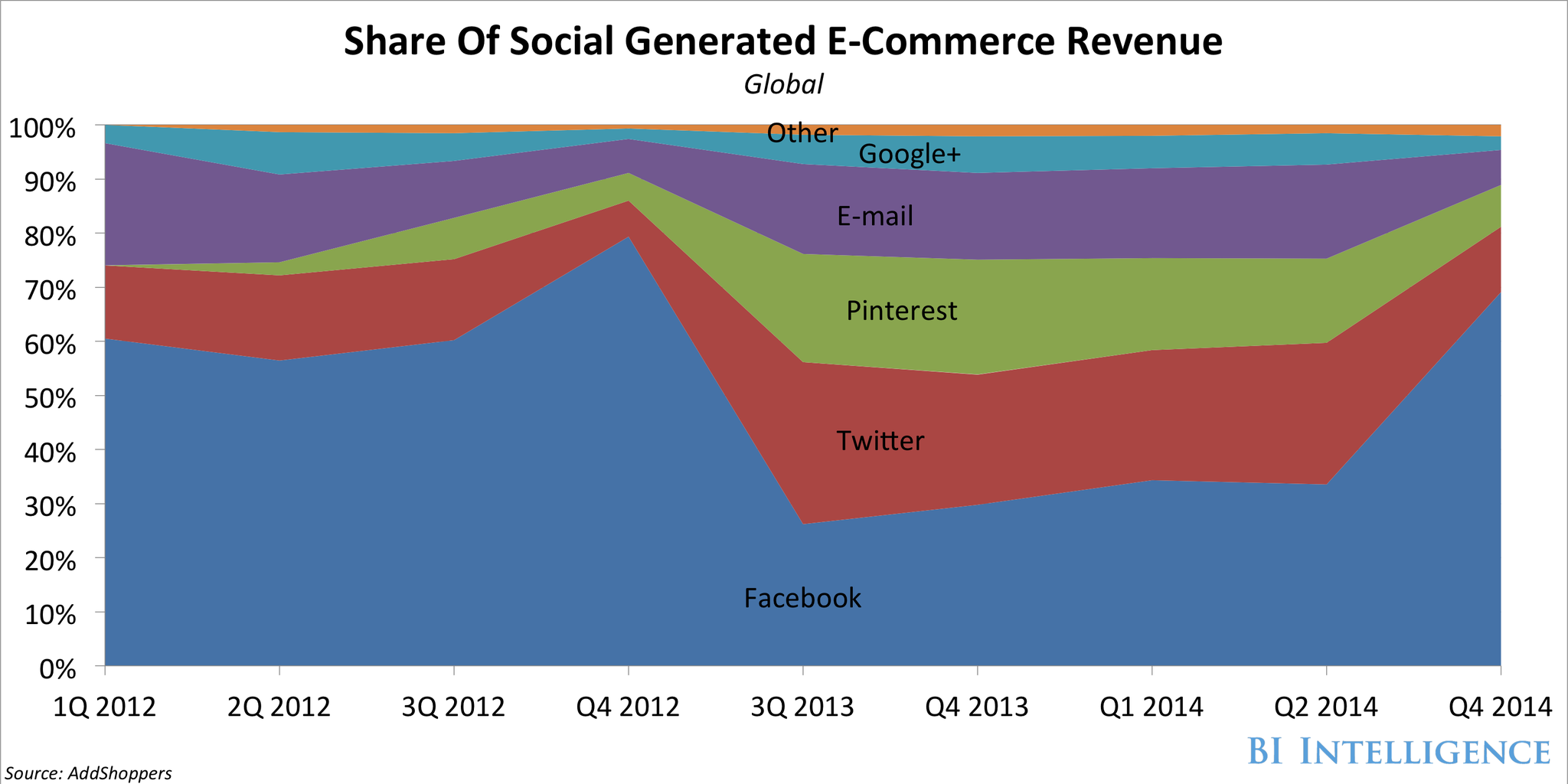

- Facebook continues to grow its lead as the dominant social commerce platform. Facebook accounts for 50% of total social referrals and 64% of total social revenue. The site's changing demographics could make older consumers a strong target for retailers leveraging the platform.

- Pinterest is a major social commerce player despite a relatively small user base. The pinning platform drives 16% of social revenue despite an audience 6.5 times smaller than Twitter. New buy and action buttons on retailer posts should make Pinterest an even stronger referral and revenue engine for brands.

- Twitter is losing its influence for mass-market merchants, but it could still have a role to play among sporting and events marketers, especially for location-based promotions. Recently, NFL and NBA teams have used Twitter to sell game tickets and merchandise.

- Instagram doesn't drive significant sales activity for retailers but high-end companies have been leveraging the platform for branding purposes. New Buy buttons on paid posts, as well as increased targeting capabilities, could make the app a more important direct-response driver.

This is just a small piece of our comprehensive 31-page report. Become an expert on the topic by accessing the full report now »

In full, the report:

- Sizes social media's role for retailers compared to other referral sources such as search and email.

- Examines how social media's transition to mobile is impacting the role of different social platforms.

- Looks at how the different social networks stack up in terms of conversion rates, share of social-generated retail sales, and average order value.

- Highlights up-and-coming social commerce players such as Snapchat and Instagram, and how brands are using them for influencer marketing.

- Outlines the latest major commerce moves by Facebook and Twitter, which could help drive up conversion rates from social.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.